Better Than Gold: Investing in Historic Cars

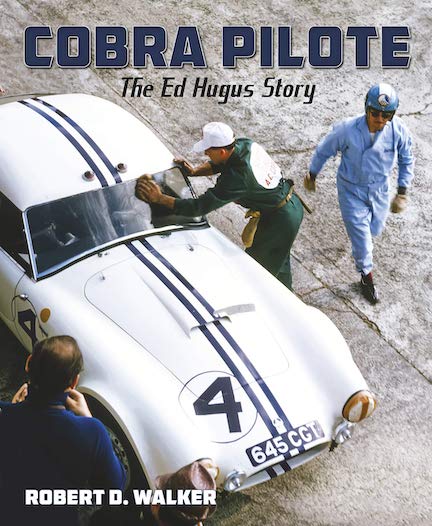

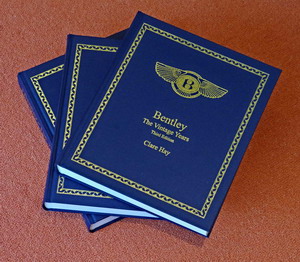

Why is it that a multi-billion dollar market has never been documented, analyzed and interpreted, despite the fact that it has existed for more than half a century? Better Than Gold addresses these questions by rigorously analyzing this collectors’ market, its trading patterns, players and market dynamics and by comparing its characteristics and performance to other collectors’ and established asset classes.

The book introduces the HAGI (Historic Automobile Group International) classic car indices, which measure this market accurately on a monthly basis using financial methodology. The four main sections of the book cover subjects such as market history and description, size, and value drivers. Using the indices, the author illustrates historic price developments of various market sections, including those of collectors’ Ferrari, Porsche, and Mercedes-Benz. It also offers fresh insight into some of the most interesting market phases, including an account of the classic car investment bubble of the late 1980s.

With a remarkable level of detail, Hatlapa elaborates on restoration of classic cars and the philosophy behind this vital activity and craft, which is essential in the value development of a car. Helped by this entirely new research, the book creates the foundation for an investment infrastructure in this asset class. With over 200 quality photographs of collectors’ cars, price performance graphs and tables, the book interweaves market theories, index analysis, personal impressions and market data.

Finally the book offers a large amount of price relevant information summarized in 14 appendices. It presents the facts in a structured way and is a useful guide for both the market novice and the experienced owner.

In the book’s first of three forewords, Karl Ludvigsen puts it best: “In this pathbreaking book Dietrich Hatlapa achieves a breakthrough by exploring in unprecedented depth and detail the factors affecting the values of classic cars and the trends that have influenced those values over the last three decades.” Reading through its four parts and 33 chapters, at times one may forget that this is squarely a business book; perhaps that’s because this is a case where we have a “car guy” who is a finance professional paving this trail, rather than a finance professional trying to template the collector car world. In his preface, Hatlapa states: “Classic cars are different from financial markets: they are a passion.”

This is more than a book. Hatlapa, a former director of ING Barings financial markets, formed a group that created HAGI in 2007 and the HAGI market indices that have been tracking decades of performance since 2008. This book shows you much of what you thought you knew in a disciplined way, but more importantly, it shows you what you later realize you should certainly know—with that, you know you’ll refer to it often.

Copyright 2016, Rubén Verdés (speedreaders.info).

This review appears courtesy of the SAH in whose Journal 278 it was first printed in substantially similar form.

RSS Feed - Comments

RSS Feed - Comments

Phone / Mail / Email

Phone / Mail / Email RSS Feed

RSS Feed Facebook

Facebook Twitter

Twitter